Original Article

, Volume: 13( 3)Efficiency Analysis of Commercial Banks in China Based on DEA and Malmquist Index

- *Correspondence:

- Feng Junwen , School of Economics and Management, Nanjing University of Science and Technology, Nanjing Jiangsu 210094, China, Tel: 08602584315093; E-mail: 313472714@qq.com

Received: March 21, 2017; Accepted: May 01, 2017; Published: May 03, 2017

Citation: Junwen F, Jie C, Yucheng W. Efficiency Analysis of Commercial Banks in China Based on DEA and Malmquist Index.Biotechnol Ind J. 2017;13(3):139.

Abstract

Commercial banks are the core of the financial systems in the real economy. The efficiency of commercial banks directly affects the allocation of social resources and the utilization of financial resources. With the change of environment at home and abroad, especially the emergence of Internet Finance and other emerging finance, bank efficiency is widely concerned. This paper establishes the evaluation index system of bank efficiency based on Data envelopment analysis (DEA), compares and analyzes the technical efficiency (TE), pure technical efficiency (PTE) and scale efficiency (SE) of state-owned commercial banks; joint-stock commercial banks; city commercial banks and rural commercial banks in 2012-2014. The results show that the performance of state-owned commercial banks is stable, and the efficiency is relatively high; The performance of joint-stock commercial banks is second only to that of state-owned banks, but there are fluctuations: PTE decreased significantly; City commercial banks, due to geographical constraints and local policy implications, the TE and SE is not ideal; The rural commercial banks have good performance in sample, TE and SE increased significantly. Finally, on the basis of empirical analysis, this paper puts forward some suggestions for various banks.

Keywords

Commercial banks; Efficiency; DEA; Malmquist index

Introduction

The commercial banks play an important role in a country’s financial system. Stable and effective operation of commercial banks is closely related to the healthy development of China's economy and social stability. Bank efficiency directly affects the allocation of social resources and the utilization of financial resources. With the advent of the era of interest rate marketization; RMB internationalization and other related financial reform continues to deepen; the emergence of Internet Finance and other emerging finance, etc. China's bank industry is different from the past. How to improve the operational efficiency of banks is becoming more and more concerned, so first we should measure the efficiency of banks.

Efficiency refers to the input-output or cost-benefit comparison relationship, so is the bank efficiency. That is: under the premise of effectively ensuring the profitability, safety and liquidity of commercial banks, commercial banks can reasonably configure bank resources and maximize the flow of social and economic resources. It is the general term of the bank's market competition ability, input-output ability and sustainable development ability. Our banks can be roughly divided into: State-owned banks, joint-stock banks, city commercial banks, rural commercial banks and foreign banks. Different banks have different efficiency, and the problem is different also. For the development of bank industry, correct evaluation of bank efficiency is the foundation of effective supervision, so bank regulators could formulate targeted regulatory measures and development policies. This paper’s purpose is to evaluate bank efficiency and analyze the changes. We hoped it will be helpful to improve the efficiency of China's banks in order to overcome the problem: input redundancy or output deficiency.

Literature Review

Banks are the main undertaker of financial activities, and a lot of scholars' try to find out problems by evaluating bank efficiency. The most important measure is the Data envelopment analysis (DEA)1 method. Zhang Lixin [1] used DEA method to establish evaluation index system of bank efficiency. The paper compared and analyzed the TE, PTE and SE of China's state-owned commercial banks, joint-stock commercial banks and city commercial banks in 2008-2009, and put forward some corresponding suggestions. Ding Zhongming and Zhang Chen [2] joined the foreign commercial banks in their sample based on the view of efficiency difference. They analyzed the management problem which existed in China commercial banks, and gave some suggestions. Liu Xin et al. [3] used the DEA method to evaluate the overall efficiency of China's banks: 2008-2012, the overall efficiency of China's commercial banks showed a steady upward trend, and the improvement of TE mainly comes from the improvement of SE. The trend of the efficiency of state-owned banks and joint-stock banks is consistent with the trend of the overall efficiency of China’s banks.

Song Zengji, et al. [4] used the year data, used the regnant and recessive efficiency of DEA model to get comprehensive efficiency ranking of China's commercial banks. He Jian and Ji Yang [5] combined canonical correlation analysis (CCA) with DEA, based on the analysis of performance of 16 listed banks in China during 2011-2013, the results showed that the overall efficiency of China's bank industry presents a "U" shape. Wu Wei et al. [6] used the DEA method and Malmquist index to compare the technical efficiency of 58 banks, including city commercial banks, joint-stock commercial banks and state-owned commercial banks. They choose the data from 2008 to 2013, They main focused the city commercial banks, divided them into eastern, central, western and northeast to discuss, and at the same time compared with state-owned banks and joint-stock banks. It is found that in recent years, the TE of China's bank industry has shown an increasing trend, but in addition to joint-stock commercial banks, the total factor productivity (TFP) of the other two banks declined, and there are obvious differences in efficiency between different scales, especially the TE of state-owned commercial banks is low.

Sherman and Gold [7] first introduced the DEA method as an effective frontier technology to evaluate the efficiency of bank industry. Pemirguc Kunt [8] chose interest margin and profit margin as efficiency index based on the data of 80 developed countries and developing countries in 1988-1995, it analyzed the determinants of bank efficiency. The results showed that foreign banks in developing countries have higher technical efficiency. It is enough to overcome the information barrier of borrowers or investors, and it is also the key to improve the bank efficiency of developing countries. Fotios Pasiouras [9] believed that the expansion of the scope of bank's business, lending activities, market share and the number of branches will help improve the bank efficiency. Allen Berger et al. [10] analyzed the bank data of China in the past ten years before and after 2000, the efficiency of state-owned commercial banks is the lowest.

Data Envelopment Analysis (DEA) and Malmquist Index

DEA introduction

DEA is a kind of objective decision-making method based on relative efficiency concept. It is based on many input-output indexes, by using the linear programming methods, a quantitative analysis method to evaluate relative effectiveness for the same type of units which is comparable.

Its principle is to maintain the decision-making unit (DMU)’s input or output unchanged, with the help of linear programming and statistical data to determine the relatively effective production frontier, each DMU is projected onto the production frontier of DEA, and their relative effectiveness is evaluated by calculating the degree of departure from the DEA frontier.

In the case of Banks, the TE of the DEA model is the ratio of optimal input to actual input when the bank is located at the production frontier with constant returns to scale. It reflects the ability of banks to minimize the input when the output is constant. Technical efficiency (TE) can be divided into pure technical efficiency (PTE) and scale efficiency (SE). PTE is the ratio of the optimal investment to actual investment when the bank is located at the production frontier with variable returns to scale, it reflects the level of bank management. The SE refers to the ratio about optimal input in the production frontier with constant returns to scale vs variable returns to scale. The relationship can be expressed as: TE=PTE*SE. These efficiency values are between 0 and 1, the closer to 1, represents the higher efficiency.

DEA correlation model

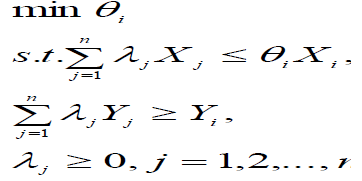

? CCR model with constant returns to scale [11]

The CCR model with constant returns to scale is the most basic DEA model. The model uses the scale invariant assumption to estimate the production boundary by linear programming, and then measures the relative efficiency of each decisionmaking unit. This model obtains the TE. The model assumes that there are no decision-making units, and each unit can use a inputs to get b outputs. The input and output vectors of the i decision units are Xi=(x1i,x2i,...xai)T and Yi=(y1i,y2i,...ybi)T. The relative technical efficiency of the i decision making units can be solved by CCR model. Among them λj (j=1,2,...n) is a decision variable; θj is scalar, 0 ≤ θi ≤ 1,When the θi=1, on behalf of it is in production frontier. The closer to 1, the higher technical efficiency.

? BCC model with variable returns to scale [12]. This model assumes that the scale is variable, that is, on the basis of CCR model, add  . Through this model, the TE which obtained in the CCR model can be decomposed, and get PTE and SE of each decision-making unit. By judging whether each decision-making unit is in the state of increasing or decreasing returns to scale, it provides the basis for decision makers to adjust the scale.

. Through this model, the TE which obtained in the CCR model can be decomposed, and get PTE and SE of each decision-making unit. By judging whether each decision-making unit is in the state of increasing or decreasing returns to scale, it provides the basis for decision makers to adjust the scale.

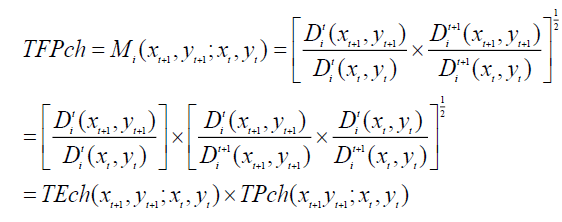

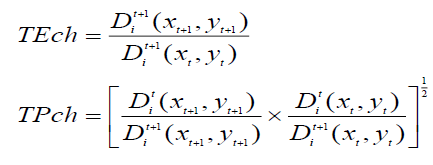

? The Malmquist DEA model [13] is based on the above two DEA models, the objective function is the ratio of t+1 phase efficiency to t phase efficiency. The Malmquist index is change rate about the total factor productivity (TFP) index, indicates the degree of change from t phase to t+1 phase. It can be decomposed into two parts: technical efficiency change index (TEC) and technical progress index (TP).

(1)

(1)

(2)

(2)

M>1, indicating an increase in efficiency. TEC measures whether there is a waste of resources and whether the resource allocation is optimal, it shows that the DMU’s degree of catching to the optimal production frontier from t~t+1. TEch >1, which indicates that the gap between the optimal production frontier is narrowing. Similarly, the TP greater than 1 represent s the progress of production technology.

Empirical Analysis of the Efficiency of Commercial Banks in China

Index selection

Commercial bank is a financial institution for the purpose of profit which can create credit, it raises funds in a variety of financial liabilities and operates a variety of technical assets. There are three ways to divide the input-output of a bank: production method, mediation method and property method (not detailed here). The DEA method has strict restrictions on the selection of indicators, and learn from the experience of previous studies, this paper adopts the mediation method: bank is an intermediary, obtain the remaining funds by residents, and then provide to the residents in need, the bank's output is the amount of deposits and loans. We select indicators, the output indicators are: the total amount of loans (y1), the most important bank earning assets; total deposits (y2); net profit (y3), reflects the profitability of banks. The input indicators are: operating expenses (x1), reflect operating costs of banks, the net value of fixed assets (x2), on behalf of the bank hardware investment, the number of employees of banks (x3), on behalf of bank's labor input.

Sample

In order to reflect the operational efficiency of China's commercial banks, in this paper, we choose the bank which is more representative in terms of asset size, management level and profitability. Including: Bank of China (BOC), China Construction Bank (CCB), Industrial and Commercial Bank of China (ICBC), Agricultural Bank of China (ABC) as the representative of state-owned commercial banks; China Minsheng Bank (CMBC), China Merchants Bank, China CITIC Bank (CITIC), Shanghai Pudong development bank as the representative of joint-stock commercial banks. Zheshang Bank, Bohai Bank, Nanjing Bank, Bank of Ningbo as the representative of city commercial banks; Shanghai Rural Commercial Bank, Tianjin Rural Commercial Bank, Guangzhou Rural Commercial Bank as the representative of rural commercial banks. Select annual data (2012-2014) from the Guotai'an database and every bank’s annual reports. In this paper, we use the input-oriented DEA model, software DEAP2.1, the results are shown in Table 1.

| 2012 | 2013 | 2014 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| crste | vrste | Scale | crste | vrste | Scale | crste | vrste | Scale | ||||

| BOC | 0.958 | 1 | 0.958 | drs | 0.998 | 1 | 0.998 | drs | 0.934 | 1 | 0.934 | drs |

| CCB | 0.921 | 1 | 0.921 | drs | 0.953 | 1 | 0.953 | drs | 0.923 | 1 | 0.923 | drs |

| ICBC | 1 | 1 | 1 | - | 1 | 1 | 1 | - | 0.981 | 1 | 0.981 | drs |

| ABC | 0.778 | 0.778 | 1 | - | 0.817 | 0.817 | 1 | - | 0.676 | 0.862 | 0.784 | drs |

| CMBC | 0.819 | 0.885 | 0.925 | drs | 0.81 | 0.81 | 1 | - | 0.76 | 0.761 | 0.998 | drs |

| Merchants | 0.906 | 0.961 | 0.942 | drs | 0.886 | 0.886 | 1 | - | 0.788 | 0.836 | 0.943 | drs |

| CITIC | 0.912 | 0.994 | 0.918 | drs | 0.974 | 0.985 | 0.989 | drs | 0.933 | 0.97 | 0.962 | drs |

| ShanghaiPudong Development | 1 | 1 | 1 | - | 1 | 1 | 1 | - | 1 | 1 | 1 | - |

| Zheshang | 0.944 | 1 | 0.944 | irs | 0.884 | 1 | 0.884 | irs | 0.873 | 1 | 0.873 | irs |

| Bohai | 0.758 | 1 | 0.758 | irs | 0.86 | 1 | 0.86 | irs | 0.848 | 0.969 | 0.876 | irs |

| Nanjing | 1 | 1 | 1 | - | 0.986 | 1 | 0.986 | irs | 0.895 | 1 | 0.895 | irs |

| Ningbo | 0.833 | 0.939 | 0.888 | irs | 0.798 | 0.916 | 0.871 | irs | 0.832 | 0.967 | 0.86 | irs |

| Shanghai RCB | 0.851 | 0.996 | 0.854 | irs | 1 | 1 | 1 | - | 1 | 1 | 1 | - |

| Tianjing RCB |

0.579 | 1 | 0.579 | irs | 0.803 | 1 | 0.803 | irs | 1 | 1 | 1 | - |

| Guangzhou RCB | 0.948 | 1 | 0.948 | irs | 1 | 1 | 1 | - | 0.976 | 1 | 0.976 | irs |

| avg | 0.88 | 0.97 | 0.909 | 0.918 | 0.961 | 0.956 | 0.895 | 0.958 | 0.934 | |||

crste:TE vrste:PTE scale:SE drs:decreasing returns to scale irs:increasing returns to scale

Table 1: Efficiency of sample banks in 2012-2014.

Empirical results analysis

From the empirical results, the state-owned commercial banks' technical efficiency showed a downward trend from 2012 to 2014. ICBC's TE, PTE, SE was 1 in 2012-2013, achieve DEA efficiency. The pure technical efficiency of BOC and CCB was 1. However, the efficiency of ABC was inferior, the downward trend is obvious. 2014, the TE reduced to 0.676, and the returns of scale also declined. ABC’s TE & SE had downward fluctuations, but PTE increased steadily.

The national joint-stock commercial banks, the efficiency of Shanghai Pudong Development Bank’s efficiency value reached 1, DEA is valid. The Minsheng Bank, China Merchants Bank, CITIC Bank’s TE are about 0.8 or 0.9. There was an upward trend about CITIC Bank’s efficiency in recent 3 years. Minsheng Bank and China Merchants Bank had a significant downward trend. They were in the stage of decreasing returns to scale, it means there were input redundancy or output deficiency, so how to improve the efficiency of fund utilizing is the key. China Merchants Bank's TE decreased from 0.906 to 0.788, for it is characterized by retail business and service innovation, Internet finance and other emerging finance has brought great impact to the Bank.

City commercial banks, Zheshang Bank, Bohai Bank, Nanjing Bank, Bank of Ningbo achieve the basic PTE efficiency in recent three years. Note that the city commercial banks have made some achievements in technological innovation, but the efficiency performance is not a line. Zhejiang Bank, Nanjing Bank showed a downward trend, Bohai Bank was on the rise. The development of city commercial banks in China isn’t mature, it is important to expanse scale now.

Because the data about rural commercial banks is less, we choose Shanghai, Tianjin, Guangzhou Rural Commercial Bank. They were reformed by the credit cooperatives in China, still in adaptation period. Three banks’ TE, PTE and SE are relatively low in 2012, about 0.6, but they achieved DEA efficiency in 2013 and 2014. It was related to state's policy of increasing support for agriculture and speeding up rural finance development. In the formal financial system of agriculture, rural commercial banks are the only real financial institutions that have business dealings with farmers, so they are highly regarded.

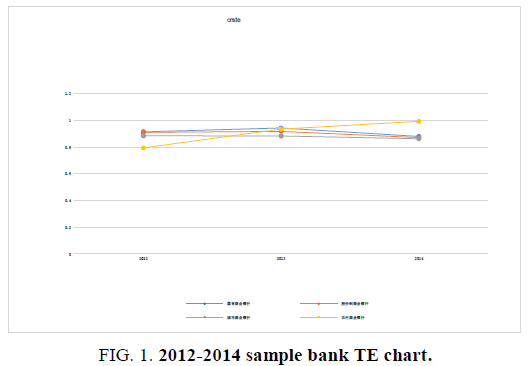

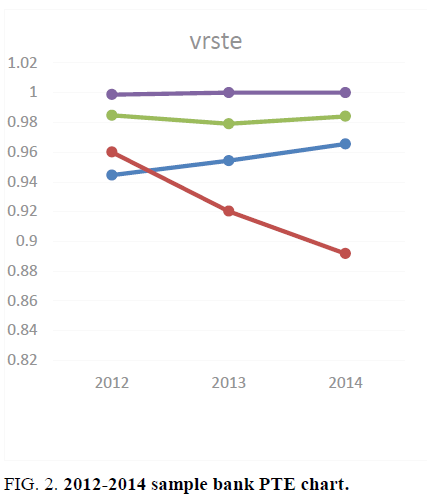

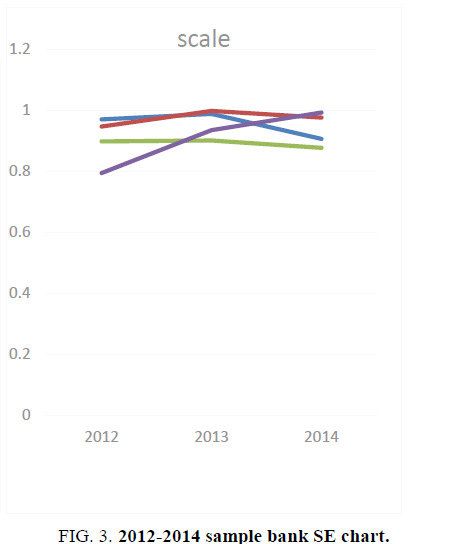

Below we will discuss the three kinds of efficiency value for the four kinds of bank in sample, see the Figure. 1-3.

From the perspective of technical efficiency, state-owned commercial banks are the highest, it has state-owned holding background, large number of outlets, gathering effect of talent, management and service, so the high TE of state-owned banks is completely understandable. State-owned commercial banks, joint-stock commercial banks, city commercial banks, their trend of TE was downward, while the TE of rural commercial banks was obviously upward. 2011, rural credit cooperatives reform began, 2012-2013 are golden age, and it was basically completed in 2015. The TE improved significantly, which shows that the technical efficiency of China's rural commercial banks is increasing year by year, rural commercial banks are booming!

In PTE part, all banks were high, joint-stock commercial banks fell significantly. This may because banks now focus on innovation, internet finance and other emerging finance. Originally joint-stock commercial banks are on competitive pressure, technical level is not perfect, and it doesn’t have policy support as state-owned banks, also unlike city and rural commercial banks began to develop. Therefore, the decline in PTE of joint-stock banks seem to be general. City and rural commercial banks performed well, the efficiency value was close to 1. It is worth mentioning that the state-owned banks’ PTE showed an upward trend, suggests that state-owned commercial banks actively innovate in the national advocate rather than confining patterns inherent.

In SE part, the efficiency of state-owned commercial banks and joint-stock commercial banks are high, but had a little decreasing trend. These banks have large scale, early establishment, many business outlets, the size may have been super optimal. City commercial banks’ performance was essentially flat, rural commercial bank rose significantly. This reflects our country's attention to the three rural issues and rural financial development. Rural commercial banks take about 90% of national agricultural policies and financial services in blank township outlets, thus rural commercial banks are in the period of scale economy.

Since the 2008 economic crisis, the domestic and international environment changes greatly. 2012, China have gradually entered the new economic normal, Internet Finance emerged, financial reform intensified, etc., they brought fresh blood to banks and caused some impact at the same time. So, I choose TFP efficiency change index (2012-2014) to decompose as shown in Table 2.

| effch | techch | pech | sech | tfpch | ||

|---|---|---|---|---|---|---|

| BOC | 0.987 | 1.019 | 1 | 0.987 | 1.006 | state-owned commercial banks |

| CCB | 1.001 | 0.981 | 1 | 1.001 | 0.983 | |

| ICBC | 0.99 | 0.971 | 1 | 0.99 | 0.961 | |

| ABC | 0.932 | 1.055 | 1.053 | 0.886 | 0.983 | |

| CMBC | 0.963 | 0.963 | 0.927 | 1.039 | 0.927 | joint-stock commercial banks |

| Merchants | 0.933 | 0.955 | 0.933 | 1 | 0.891 | |

| CITIC | 1.012 | 0.971 | 0.988 | 1.024 | 0.982 | |

| Shanghai Pudong Development | 1 | 1.006 | 1 | 1 | 1.006 | |

| Zheshang | 0.962 | 0.978 | 1 | 0.962 | 0.94 | City commercial bank |

| Bohai | 1.058 | 0.979 | 0.984 | 1.075 | 1.036 | |

| Nanjing | 0.946 | 0.971 | 1 | 0.946 | 0.918 | |

| Ningbo | 0.999 | 0.951 | 1.015 | 0.984 | 0.951 | |

| Shanghai RCB | 1.084 | 0.993 | 1.002 | 1.082 | 1.077 | Rural commercialbank |

| Tianjing RCB | 1.315 | 1.127 | 1 | 1.315 | 1.481 | |

| Guangzhou RCB | 1.014 | 0.99 | 1 | 1.014 | 1.004 | |

| avg | 1.01 | 0.993 | 0.993 | 1.017 | 1.003 |

Effch:TE change index; techch:Technical change index pech:PTE change index; Sech:SE change index; tfpch: malaquist

Table 2: TFP efficiency change index decomposition of sample banks in 2012-2014.

From Table 2, we know the average value of M index about 15 banks during sample period was about 1.003, This shows that total factor productivity is essentially flat. From the efficiency decomposition index, the efficiency change index of rural commercial banks is more than 1, it shows that both the production technology and management level have certain promotion in 2012-2014. For other banks, the average M index of state-owned banks is less than 1, so productivity declined, it may due to the decline of scale efficiency. After the bank reached a certain scale, the scale is not economic, which restricts the development of its advantages. But it was also found that the overall PTE change index is greater than 1, so technical innovation is accelerated. Joint-stock commercial banks performed slightly worse than state-owned banks. City commercial banks’ M index is less than 1, so productivity declined. For city commercial banks, the relative backwardness of management is bottleneck which restricts total factor productivity growth, and it may have caused by backward management concept, the local government intervention, the limited network and regional services.

Conclusions and Suggestions

Main conclusions

From the sample, state-owned commercial banks’ TE have been maintained at high level, SE is relative high, but had a downward trend. PTE was on the rise, so technology development is in progress. Total factor productivity has declined. Joint-stock commercial banks are slightly lower than state-owned banks in TE, and PTE decreased significantly, total factor productivity has partially declined. From perspective of exponential decomposition, how to improve PTE efficiency should be concerned. All kinds of efficiency for city commercial banks was essentially flat in sample period, slow development, total factor productivity also declined. The TE of rural commercial banks were relatively low, but kept rising in 2012-2014, it was even more than state-owned banks and joint-stock banks in 2014. The total factor productivity increased, and the change rate of TE, PTE, SE were greater than 1, indicating the technological progress and management level are improved.

Compared to previous article mentioned in the literature, I joined the rural commercial banks in my study, and the time is from 2012 to 2014, more comprehensive and updated. There are some similarities and differences between my conclusion and former conclusion. The similarities: the TE of state-owned and joint-stock commercial banks are generally high, and PTE is both poor; there is a certain gap between the city commercial banks’ efficiency performance with the former. Differences: most of researches shows that state-owned banks’ scale efficiency is low, but my study shows the SE is still relatively high and had a decline in 2012-2014. I think the reason maybe that, those research are done before 2012, but in recent years, China's economic environment has changed greatly, the state-owned banks may respond positively to the national financial reform and get a small effect. Of course, it is not means the scale is not a trivial problem. At the same time, the PTE of joint-stock firms decreased obviously in my study, which may be related to the financial reform and emerging finance. And the TE gap for city commercial banks became small, it shows that city commercial banks developed steadily in 2012-2014. Finally, it is easy to find the rapid development of rural commercial banks.

In summary, the overall commercial banks in China had efficiency fluctuation in 2012-2014 base on my research, a little downward trend, because commercial banks’ operating efficiency is easily affected by external environment. For instance, the macroeconomic slowdown. But overall, banks still get good results under the increasingly complex ever-changing business environment. Of course, the problem which appeared in development cannot be ignored, in terms of these problems, we put forward the following suggestions.

Some Suggestions

The state-owned commercial banks should control scale, although their SE were relative high in my study, but the returns to scale is decreasing and the problem of excessive dot and redundant phenomenon are still serious. They can use a lot of electronic network services replace human resources and establish an effective incentive mechanism, improve the efficiency of staff and competition consciousness. Speed up the business pattern transform to intensive type, revoke or merger branches which are not economic, reduce business expenses. At the same time, continue to maintain technological innovation, optimize the structure. The joint-stock commercial banks are vulnerable in recent years due to market changes, they need to improve competitiveness. Pay attention to introduction of new technology and talents, improve management level and accelerate technological progress. They can also consider, on the basis of abundant theoretical and practical achievements of foreign commercial banks, through intermediate business innovation to accelerate the pace of financial innovation, realize comprehensive innovation about business strategy, management system, financial tools, transmission mechanism, and technology application.

City commercial banks, due to geographical constraints, the management is not perfect. First, expanse scale reasonably and actively expand business, strengthen business cooperation with big banks, attract and stabilize customers with the help of big banks’ advantages. Second, improve management level, learn advanced management experience. In the aspect of corporate governance, must strictly abide by the laws, regulations and refined corporate governance guidelines. At the same time, cultivate business innovation ability, enhance attractiveness of talents, build characteristics financial products, distribute internet finance and develop small and micro finance.

Rural commercial banks performed greatly in sample, but it doesn’t mean there’s no problem, the sample cannot represent overall situation. Our country proposes to intensify rural finance development, release preferential policies about agricultural deposits and loans, concern agriculture-countryside-farmer issues, rural commercial banks development have made certain achievements. However, rural commercial banks are reformed by credit cooperatives, still in adaptation period, so there are many problems. For example, policy implementation doesn’t reach the designated position; rural finance disorderly competition; historical issues, etc. So, we must clearly recognize that rural commercial banks still have a long way to be mature.

Overall, the one-sided pursuit of scale is no longer the development plan of banks, efficiency and quality improvement are focus. Effectively strengthen the supervision of commercial banks is also concerned. In recent years, our economic situation is not stable for frequent global financial crisis, China bank system is in mature transition period now, we should pay more attention to financial security and improve the banks’ risk level.

References

- Lixin Z. Evaluation of the efficiency of China's commercial banks based on DEA. Shandong soc sci. 2012;19701:142-5.

- Zhongming D, Chen Z. An empirical study on the efficiency of commercial banks based on DEA method. Manag world. 2011;21003:172-3.

- Xin L, Tingting L, Xiang Z. An empirical analysis of the efficiency of Chinese commercial banks based on DEA method. Journal of Liaoning Technical University. 2016;35:219-24.

- Zengji S, Zongyi Z, Mao Y. Empirical analysis of efficiency of Chinese bank industry based on DEA. Systeng theory prac. 2009;2912:105-10.

- Jian H, Yang Y. Evaluation of input-output performance of listed commercial banks in China. Friends accounting. 2016;52901:61-5.

- Wei W, Dan L, Tao W. Efficiency analysis of commercial banks based on DEA and Malmquist productivity index. Finance and Accounting Monthly. 2015;73927:82-5.

- Sherman HD, Gold F. Bank branch operating efficiency: Evaluation with data envelopment analysis. J BankFin. 1985;9(2):297-315.

- Kunt P. Determinants of commercial banks interest margins and profitability: Some international evidence. World Bank Econ Rev. 1999;13:379-408.

- Pasiouras F. Estimating the technical and scale efficiency of Greek commercial banks: The impact of credit risk, off-balance sheet activities, and international operations. Res Int Bus Fin. 2008;22(3):301-18.

- Charnes A, Cooper WW, Rhodes E. Measuring the efficiency of decision making units. Eur J Oper Res. 1978;2(6):429-44.

- BergerAN, KickT, SchaeckK. Executive board composition and bank risk taking. Econstor;2012.

- Banker RD, Charnes A, Cooper WW. Some models for estimating technical and scale inefficiencies in data envelopment analysis. Manage Sci. 1984;(9):1078-92.

- Fare R, Grosskop S, Norris M. Productivity growth, technical progress and efficiency change in industrialized countries. Am Econ Rev. 1994;84(1):66-83.