Taxation

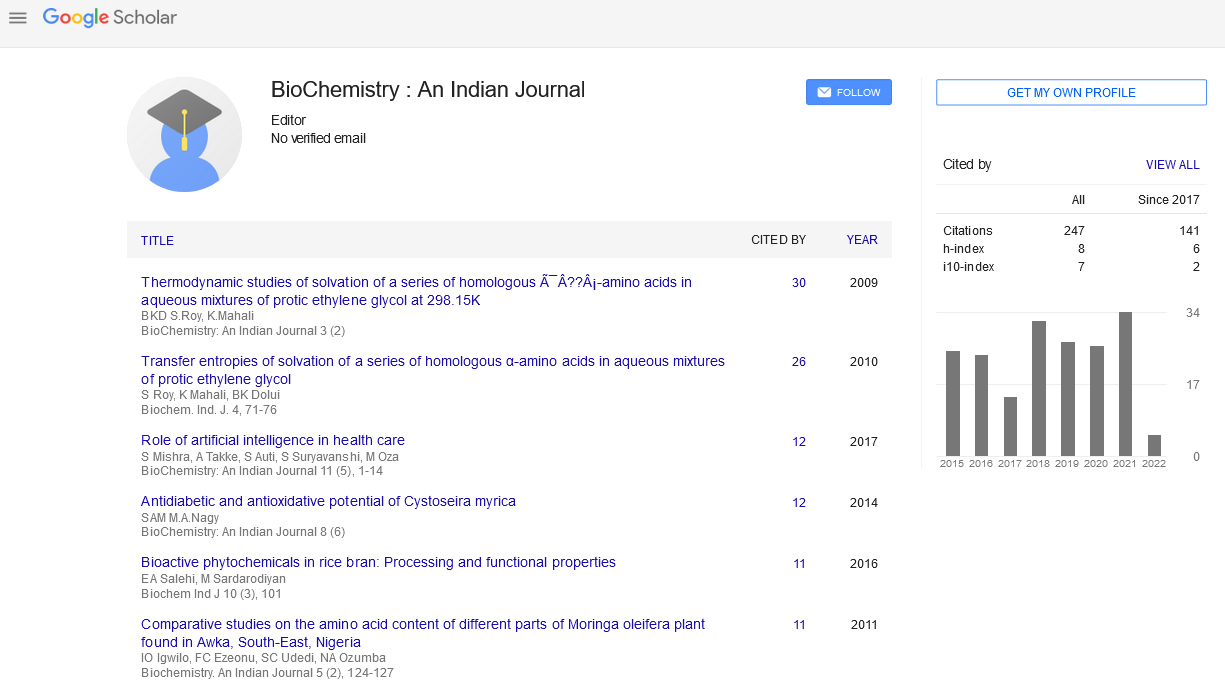

Tax assessment is the methods by which a legislature or the burdening authority forces or collects an expense on its residents and business elements. From personal duty to products and ventures charge (GST), tax assessment applies to all levels.The Central and State government assumes a noteworthy job in deciding the expenses in India. To smooth out the procedure of tax collection and guarantee straightforwardness in the nation, the state and focal governments have attempted different strategy changes throughout the most recent couple of years. One such change was the Goods and Services Tax (GST) which facilitated the assessment system on the deal and liberation of products and ventures in the country.Indirect Tax:It is characterized as the duty imposed not on the pay, benefit or income yet the merchandise and enterprises rendered by the citizen. Not at all like direct duties, aberrant expenses can be moved starting with one individual then onto the next. Prior, the rundown of circuitous duties forced on citizens included help charge, deals charge, esteem included expense (VAT), focal extract obligation and customs obligation. Be that as it may, with the execution of merchandise and ventures charge (GST) system from 01 July 2017, it has supplanted all types of backhanded expense forced on products and enterprises by the state and focal governments. GST has not exclusively been decreased the physical interface yet additionally bring down the expense of consistence with the unification of the circuitous charges.High Impact List of Articles

-

Paraoxonase 1 in women with Polycystic Ovary Syndrome

Doddappa Bannigida, Shivananda Nayak*Research: BioChemistry: An Indian Journal

-

Paraoxonase 1 in women with Polycystic Ovary Syndrome

Doddappa Bannigida, Shivananda Nayak*Research: BioChemistry: An Indian Journal

-

Biocatalytic reduction of aromatic ketones with the aid of electrochemical regeneration of the coenzyme

Tomoko Matsumura, Takamitsu Utsukihara, Kaoru Nakamura, Nakahide KatohOriginal Article: BioChemistry: An Indian Journal

-

Biocatalytic reduction of aromatic ketones with the aid of electrochemical regeneration of the coenzyme

Tomoko Matsumura, Takamitsu Utsukihara, Kaoru Nakamura, Nakahide KatohOriginal Article: BioChemistry: An Indian Journal

-

Can glycated hemoglobin be a biomarker for iatrogenic pancreatic iron deposition due to repeated blood transfusion in ÃÂâ thalassemia major? A pilot study in north indian population

Megha Arora, Kamna Singh, Binita Goswami, Ritu SinghOriginal Article: BioChemistry: An Indian Journal

-

Can glycated hemoglobin be a biomarker for iatrogenic pancreatic iron deposition due to repeated blood transfusion in ÃÂâ thalassemia major? A pilot study in north indian population

Megha Arora, Kamna Singh, Binita Goswami, Ritu SinghOriginal Article: BioChemistry: An Indian Journal

-

Study on factor H mediated identification of staphylococcal Sbi protein in pure culture

Tania Majumdar, Runu Chakraborty, Utpal RaychaudhuriOriginal Article: BioChemistry: An Indian Journal

-

Study on factor H mediated identification of staphylococcal Sbi protein in pure culture

Tania Majumdar, Runu Chakraborty, Utpal RaychaudhuriOriginal Article: BioChemistry: An Indian Journal

-

Urinary lipid quantitation in nephrotic syndrome

Jeevan K.Shetty, Shivananda B.Baliga, Mungli Prakash, K.Gopalakrishna, Sanath Sadananda, B.ShivarajOriginal Article: BioChemistry: An Indian Journal

-

Urinary lipid quantitation in nephrotic syndrome

Jeevan K.Shetty, Shivananda B.Baliga, Mungli Prakash, K.Gopalakrishna, Sanath Sadananda, B.ShivarajOriginal Article: BioChemistry: An Indian Journal