Original Article

, Volume: 13( 2)Direct Measurement and Indirect Verification on the Intensity of ChinaâÃâ¬Ãâ¢s Capital Controls

- *Correspondence:

- ZENG Shao-Long, , Economics and Management School of Hangzhou Normal University, Hangzhou, PR China, Tel: +8613857961906; E-mail: 13857961906@126.com

Received: February 10, 2016; Accepted: March 13, 2016; Published: March 15, 2016

Citation: ZENG Shao-Long. Direct Measurement and Indirect Verification on the Intensity of China’s Capital Controls. Biotechnol Ind J.2017;13(2):129.

Abstract

The RMB is included in the SDR basket on Oct. 2016, China's capital account liberalization will face new challenges, and the impact of international short-term capital flows on China's financial security will exceed our understanding. Therefore, it is necessary to measure the intensity of China’s capital control objectively. This paper summarizes the existing literature on capital control intensity, and develops the method of measurement. Using the new method to measure the intensity of China’s capital controls. The results show that the intensity of China’s capital control measured in different methods is basically consistent. The intensity of China's capital controls tends to be weakened in general, and the relaxation of capital inflow control precedes capital outflow control. The intensity changes of China's capital control would be reflected on the volatility in international capital flows inevitably. Especially the short-term international capital flows have a higher correlation with the adjustment of the intensity of capital control.

Keywords

Intensity of capital controls; China’s capital controls; Measurement; Verification

Introduction

Chinese Renminbi (RMB) was included in SDR basket as fifth currency starting October 1, 2016. It’s an important milestone for China's financial integration into the global financial system. It’s also a recognition of the progress made by the Chinese government over the past few years in reforming the monetary and financial system. Although Chinese RMB to be the real sense of the world's reserve currency still have a long way to go, but the successful participation into SDR is undoubtedly a new starting point for the RMB and China's financial markets go into the international arena. In the current international monetary system, security assets have been in a state of short supply. RMB is included in the SDR basket by IMF [1], means that China will shoulder the responsibility to provide RMB security assets to the world. The increasing demand for RMB financial assets from overseas investors may have an impact on China's financial market reform strategies, which include market-oriented reforms on interest rate and exchange rate. Since China's stock market and foreign exchange market turmoil in 2015, there is room for further improvement in China's financial system and regulatory system. In future since the success of the RMB into the SDR basket, China's capital account liberalization will face many new challenges. Meanwhile the impact and influence of the international short-term capital flows on China's financial security will exceed our existing understanding.

For a long time, China's rapid economic development has made important contributions to world economic development. China has also become a preferred country for international capital, especially for short-term international capital. Since China's accession into the WTO and complying trade liberalization, the short-term international capital flows into and out China more frequently. This brings serious challenges to China's financial stability. Meanwhile China's capital controls become the last barrier for China to response the impact and influence of international capital flows [2]. As the impact of international capital flows on China's financial economy is changing in different times, the intensity of China's capital controls is changing too. The overall adjustment trend of the intensity is in line with the trend of global economic integration and China's economic development. Therefore, it is necessary to measure the intensity of China's capital controls objectively. This article will analyze and discuss the intensity of China's capital control from three aspects: current situation of China's capital control, direct measurement on the intensity of China's capital controls, and indirect verification on the intensity of China's capital controls.

The Current Situation of China's Capital Control

At present, China's capital accounts have not fully exchangeable yet, reflected in the control of transactions and exchange. Since the Reform and Opening, China's foreign exchange management system has been adapted to the overall goal of economic reform and opening up and the trend of economic and financial globalization. It has played an important role in stabilizing cross-border capital flows, coordinating and promoting reforms in other areas, and opening to the outside world. China's capital control policy and the reform of foreign exchange management system are complementary. So the reform of foreign exchange management system reflects the changes in China's capital controls policy.

The History of China's Foreign Exchange Management System

Since Reform and Opening, China's foreign exchange management system has undergone three reforms, as list in below:

The 1st stage is from 1978 to 1993. In this period, the reform of foreign exchange system was accelerated to meet the needs of economic development. The unified revenue and expenditure system of foreign exchange was gradually changed, and export enterprises were allowed to have a certain degree of foreign exchange autonomy. Since 1979, China began to implement enterprise foreign exchange retention system, and allowed to adjust foreign exchange surplus between enterprises. The market exchange rate is in parallel with the official exchange rate for RMB foreign exchange swap. In December 1980, the State Council promulgated the "Interim Regulations on Foreign Exchange Management of the People's Republic of China", which is the basic foreign exchange regulations at this stage.

The 2nd stage is from 1994 to 2000. In this period, China initially established the foreign exchange management system framework that adapt to the socialist market economic system. At this stage, the base market for supply and demand of foreign exchange was expanded constantly, and the basic position of the market mechanism to allocating foreign exchange resources had been strengthen further. But in a whole, China's foreign exchange resources are still in short supply. Therefore, China established the import and export verification system by which to check whether the import and export logistics and capital flows are correspond. The aim was to prevent the export of foreign exchange receipts and the import of excess remittances. At that time, only a small number of enterprises allowed to open a foreign exchange account with approval, and the account can only retain 15% of the previous year's import and export foreign exchange. Individuals can only buy 500 US dollars for private use each person. And over-limit purchase of foreign exchange required approval of foreign exchange administrative department.

The 3rd stage is since 2001. In this period, China continue to deepen the reform of foreign exchange management system to adapt to the new situation. In the end of 2001 China became a member of the WTO. Since then on, China’s foreign trade developed rapidly which brought rapid expansion of foreign trade surplus. Meanwhile, foreign investment in China was actively, and the international balance of payments continued large double surplus. Under this situation, the approval for opening current account foreign exchange account was gradually eliminated, and the account quota management was eliminated too. Enterprises was allowed to retain foreign exchange reserves. Some terms were canceled, such as foreign exchange risk review, foreign exchange source review and other foreign direct investment management approval project. In securities market has introduced qualified foreign institutional investors (QFII) and qualified domestic institutional investors (QDII) successively. During this period, the principle and system of the balance management of inflow and outflow of foreign exchange capital were established step by step. The process of capital account convertibility was promoted steadily, and the foreign exchange management of trade and investment was continuous facilitation.

In summary, with the implementation and in-depth of China's economic reform and opening up, China's economic system had transition and improvement from planned economy to market economy. Meanwhile, China's foreign exchange management system in turn experienced a unified national management, corporate foreign exchange retention system, constraint settlement of exchange system, willingness settlement of exchange system. With the changes of the foreign exchange management system, China's capital controls also have obvious stage characteristics, from complete control to partial control, and to the present balance control. All these reflected the Chinese government's understanding of international capital changes from the emphasis on international capital inflows to the international equilibrium fluctuation of capital inflow and outflow.

The Current Framework of China's Capital Control

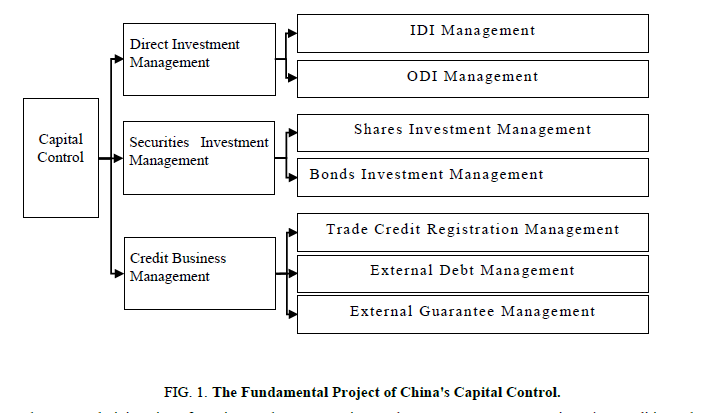

The current framework of China's capital control can be divided into three parts: direct investment, securities investment and credit business. The direct investment includes inward direct investment and outward direct investment. The securities investment includes shares investment and bonds investment. The credit business includes foreign debt management, trade credit registration management and external guarantee management (Figure. 1). According to the different aspects of capital control, capital control can be divided into cross-border capital transactions (including transfer payments) and exchange restrictions1.

Figure 1: The Fundamental Project of China's Capital Control.

Source: According to the State Administration of Foreign Exchange, "Foreign Exchange Management Overview" (2009 edition, Chapter III) [3].

Direct Measurement on the Intensity of China's Capital Control

Construction of direct measurement index system

The intensity of capital controls can be measured directly through the degree of capital account liberalization for which reflects the intensity of capital controls on the other hand. El-Shagi and Schindler [4,5] have constructed the indexes of inflow and outflow capital control intensity independently based on annual report on exchange arrangements and exchange restrictions (AREAER) [6]. According to the detailed information on AREAER, the indicators of capital inflow control and capital outflow controls can be constructed separately. The indicators set more detailed, the more truly reflect the intensity of a country's capital controls. The AREAER contains information on five asset markets and three credit markets, with a detailed record of capital controls in each market. Therefore, based on the AREAER, it is possible to construct a capital control index system with 26 indicators (Table 1). The measurement results obtained by the index system can reflect the intensity of capital controls and its change more truly.

| Capital controls index | Capital inflow | Capital outflow | |

|---|---|---|---|

| (1)Shares(2)Bonds | PLNR | × | |

| (3)MMI (4)CIS | SLNR | × | |

| (5)Derivatives | PAR | × | |

| SAR | × | ||

| (6)Commercial credit (7)Financial credit (8)Credit guarantee | R→NR | × | |

| NR→R | × | ||

| Controls considered | 13 | 13 | |

Note: "×" means that the corresponding indicators of the implementation of capital controls. Each indicator is assignment according to the relevant information on the AREAER of IMF.PLNR:Purchase locally by non-residents.SLNR: Sale or issue locally by non-residents.PAR: Purchasebroad by residents.SAR: Sale or issue abroad by residents.R→NR: From residents to non-residents.NR→R: From non-residents to residents.

Table 1: Direct measurement index system of capital controls.

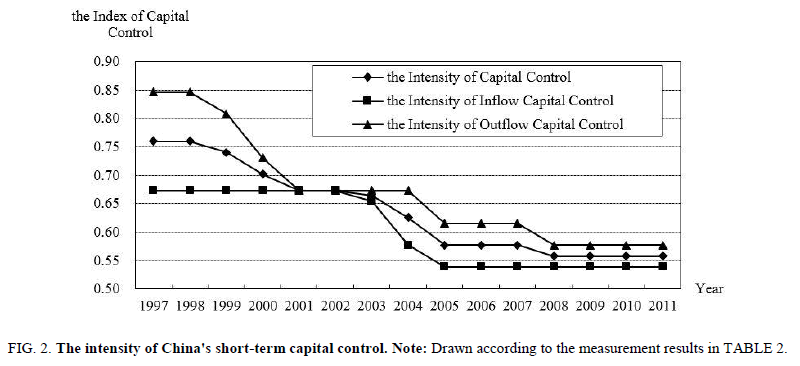

Direct measurement on the intensity of China's capital control: Based on the above index system, according to the description of China's capital controls in AREAER, we can get the intensity changes of China's capital control (Table 2, and Figure. 2).Figure. 2shows that 2001 is a watershed in the intensity of China's capital controls. Before 2001, the intensity of China's capital control was obviously uneven between outflows and inflows. Capital control of outflow was stronger than that of inflow. Since 2001, the difference of intensity between the inflows and outflows capital controls becomes smaller gradually. In Figure. 2, the curves of capital inflows and outflows tend to converge.

Figure 2: The intensity of China's short-term capital control. Note: Drawn according to the measurement results in TABLE 2.

| Years | Asset market | Credit market | FDI | Long - term capital | Short - term capital | |||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Shares | Bonds | MMI | CIS | Derivatives | Commercial credit | Financial credit | Credit guarantee | |||||||||||||||||||||||||

| PLNR | SLNR | PAR | SAR | PLNR | SLNR | PAR | SAR | PLNR | SLNR | PAR | SAR | PLNR | SLNR | PAR | SAR | PLNR | SLNR | PAR | SAR | R→NR | NR→R | R→NR | NR→R | R→NR | NR→R | OFDI | IFDI | Short - term capital | Capital inflow | Capital outflow | ||

| 1997 | 0.75 | 1.00 | 1.00 | 0.50 | 1.00 | 1.00 | 1.00 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 1.00 | 0.50 | 1.00 | 0.50 | 0.50 | 0.50 | 0.50 | 0.25 | 0.38 | 0.76 | 0.67 | 0.85 |

| 1998 | 0.75 | 1.00 | 1.00 | 0.50 | 1.00 | 1.00 | 1.00 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 1.00 | 0.50 | 1.00 | 0.50 | 0.50 | 0.50 | 0.50 | 0.25 | 0.38 | 0.76 | 0.67 | 0.85 |

| 1999 | 0.75 | 1.00 | 1.00 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 1.00 | 0.50 | 1.00 | 0.50 | 0.50 | 0.50 | 0.50 | 0.25 | 0.38 | 0.74 | 0.67 | 0.81 |

| 2000 | 0.75 | 1.00 | 1.00 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.25 | 0.38 | 0.70 | 0.67 | 0.73 |

| 2001 | 0.75 | 0.75 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.25 | 0.38 | 0.67 | 0.67 | 0.67 |

| 2002 | 0.75 | 0.75 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.25 | 0.25 | 0.25 | 0.67 | 0.67 | 0.67 |

| 2003 | 0.50 | 0.75 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.25 | 0.25 | 0.25 | 0.66 | 0.65 | 0.67 |

| 2004 | 0.50 | 0.75 | 0.50 | 0.50 | 0.50 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 0.50 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.25 | 0.25 | 0.25 | 0.63 | 0.58 | 0.67 |

| 2005 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 1.00 | 0.50 | 0.50 | 0.50 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.25 | 0.25 | 0.25 | 0.58 | 0.54 | 0.62 |

| 2006 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 1.00 | 0.50 | 0.50 | 0.50 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.25 | 0.25 | 0.25 | 0.58 | 0.54 | 0.62 |

| 2007 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 1.00 | 0.50 | 0.50 | 0.50 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.25 | 0.25 | 0.25 | 0.58 | 0.54 | 0.62 |

| 2008 | 0.50 | 0.00 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 1.00 | 0.50 | 0.50 | 0.50 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.25 | 0.25 | 0.25 | 0.56 | 0.54 | 0.58 |

| 2009 | 0.50 | 0.00 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 1.00 | 0.50 | 0.50 | 0.50 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.25 | 0.25 | 0.25 | 0.56 | 0.54 | 0.58 |

| 2010 | 0.50 | 0.00 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 1.00 | 0.50 | 0.50 | 0.50 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.00 | 0.00 | 0.00 | 0.56 | 0.54 | 0.58 |

| 2011 | 0.50 | 0.00 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 1.00 | 0.50 | 0.50 | 0.50 | 1.00 | 0.50 | 0.50 | 1.00 | 1.00 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.00 | 0.00 | 0.00 | 0.56 | 0.54 | 0.58 |

Note: 1 that completely prohibited or very strict capital entry and exit conditions are generally not easy to achieve; 0.5 said more stringent conditions, but conditions can be achieved when the capital into the control; 0 said there is no basic limit. The non-residents in the local sales or distribution of stock index scores set to four grades: 0 that can sell or can be issued A, B shares; 0.5 that can sell A, B shares, but cannot be issued; 0.75 said transactions are limited to B Shares; 1 that non-residents cannot be sold or issued in the local stock. Direct investment is divided into four levels: encouragement, permitting, restriction and prohibition.

Table 2: Different clinical presentations of celiac disease.

From 1978 to 2001: Beginning in 1978, according to the needs of reform and development, China focused on attracting and use of FDI by deregulating long-term capital controls. In fact, this started the RMB capital account convertibility process. The capital controls of this stage have three characteristics: Firstly, the object that was managed mainly in FDI, followed by external debt, and securities investment is strictly limited. Secondly, in the ideas of management was oriented in encouraging the inflow while limiting outflow. From the practice of open, the business of inflow direction is the first to open no matter in FDI, debt and other specific types of business. Thirdly, practice of capital control has experienced repeated process as release-control-then release. In 1996, China announced the realization of the current account convertibility, and began to focus on capital account liberalization. But after the outbreak of the Asian financial crisis in 1997, Chinese government has strengthened capital controls, especially the capital outflow control. Such as prohibit purchase of foreign exchange for early repayment, which was canceled until the end of the Asian financial crisis.

From 2001 to present: Since 2001, in line with the challenge of joining WTO and integrating into the economic globalization, the pace of capital account liberalization has been gradually accelerated and deepened according to the objective needs of economic development and needs of reform and opening up.

Firstly, the focus of capital control has changed. Management of FDI has been relatively mature, and in this field capital control was deregulated basically. In the field of securities investment, capital flow was experiencing an important period from prohibition to concession. Especially in the period of rapid expansion of international capital flows, how to share the results of international capital market development through participating in international financial market, and how to effectively prevent and dissolve financial risks while making use of international financial markets becomes problems that regulators cannot avoid. In response to this situation, China launched the qualified foreign institutional investor system (QFII) in 2002 to allow foreign investors to invest in China's capital market. Subsequently, China launched a series of measures such as liberalizing banks, securities, insurance and other financial institutions to engage in overseas securities investment with their own capital or valet.

Secondly, the philosophy of capital controls has changed to a relatively balanced controls, while the controls on capital inflows much more deregulated than that on outflows before. Since 2002, China has large double surplus with Current Account and Capital Account, accompanied by rapid growth of foreign exchange reserves. This not only reflects the Comprehensive National Power of China becoming strength continuously, but also partly reflects the low efficiency of China's capital use. The problem that the regulators faced was not only confined in trying to attract FDI, but also how to achieve a rational allocation of resources by using domestic and international markets effectively. In this situation, the capital controls began to encourage the orderly capital outflows and prevent speculative capital inflows, and promote basic balance on the international balance of payment. After the global financial crisis in 2008, China has gradually accelerated the liberalization of Capital Account. The Third Plenary Session of the 18th Central Committee of the CPC pointed out " We will promote the opening of the capital market in both directions, raise the convertibility of cross-border capital and financial transactions in an orderly way, establish and improve a management system of foreign debt and capital flow within the framework of macro-management, and accelerate the realization of Renminbi capital account convertibility".

Indirect Measurement on the Intensity of Capital Controls

In fact, capital account liberalization and capital controls like a coin with two sides: the weaker the capital controls, the more open the capital account, and vice versa. Thus, the economic indicators that measure the degree of openness of capital account also measure the intensity of capital controls indirectly. There are three groups of economic indicators that used commonly: the correlation between savings and investment, differences in return on assets, and the scale of international capital flows.

Correlation between savings and investment

Theoretically, the stronger the correlation between savings and investment, the stronger the intensity of capital controls. Feldstein and Horioka [7] analyzed the correlation between the savings rate and the investment rate for 21 OECD countries for the period 1960 to 1974, and analyzed the intensity of capital controls for these 21 countries. The results of this paper show that: with perfect world capital mobility, there is little or no relation between the domestic investment in a country and the amount of savings generated in that country. On the other hand, the higher the correlation between the savings rate and the investment rate, the weaker the capital mobility and the stronger the intensity of capital control. This criterion was rejected by Obstfeld [8], who argued that a country's savings rates and investment rates are highly correlated with the full liberalization of the capital account, and that correlation are more obvious for the large economy. Although this method is criticized, it still has some reference value.

Difference in Return on Assets

The greater the difference in return of capital between domestic and foreign, the stronger the intensity of capital controls. The interest rate parity theory shows that: when a country's capital account is fully liberalization, the interest rates between domestic and international are in line with the interest parity relationship. Which means the domestic interest rate plus the expected rate of change in the exchange rate should be equal to the international interest rate. As long as there are differences, the international capital arbitrage behavior will cause the differences to be reduced or cause the exchange rate of the relevant currency to be changed. These will maintain the interest parity relationship. Therefore, the intensity of capital controls can be verified indirectly according the interest rate parity theory. The higher the degree of relation between domestic interest rate and international interest rate, the weaker the intensity of capital control.

Scale of international capital flows

The indicators of international capital flows reflect the degree of capital account opening, which can verify the intensity of capital control changes indirectly. These indicators include the proportion of each capital item in GDP mainly. This method is similar to the method of measuring the opening degree of international trade, which is measured through the scale of international trade. Meanwhile the scale of international capital flows can be distinguished inflow and outflow. Although the annual series of the scale of capital flows fluctuate greatly, but it well reflects the trend of the intensity of capital control in the long run.

Indirect Verification on the Intensity of China's Capital Controls

Based on the availability of data, two methods is used to indirectly verify the intensity of China's capital control that was measured directly above. These methods are the correlation of savings rate and investment rate, and the actual amount of capital flows.

Savings- investment rate correlation

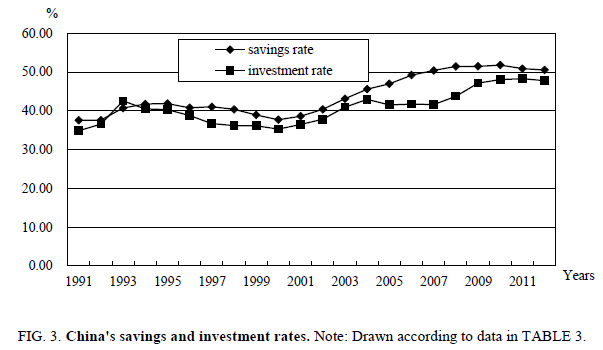

Using the relevant data in the China Statistical Yearbook, can analyze China's savings and investment behavior since 1991. And calculates the correlation coefficient between them to reflect the intensity of China's capital control indirectly. The results are shown in (Table 3), (Figure. 3).

| Years | Expenditure Method GDP | Total Consumption | Total Investment | Consumption Rate | Savings rate | Investment rate |

|---|---|---|---|---|---|---|

| 1991 | 22577.4 | 14091.9 | 7868 | 62.42 | 37.58 | 34.85 |

| 1992 | 27565.2 | 17203.3 | 10086.3 | 62.41 | 37.59 | 36.59 |

| 1993 | 36938.1 | 21899.9 | 15717.7 | 59.29 | 40.71 | 42.55 |

| 1994 | 50217.4 | 29242.2 | 20341.1 | 58.23 | 41.77 | 40.51 |

| 1995 | 63216.9 | 36748.2 | 25470.1 | 58.13 | 41.87 | 40.29 |

| 1996 | 74163.6 | 43919.5 | 28784.9 | 59.22 | 40.78 | 38.81 |

| 1997 | 81658.5 | 48140.6 | 29968 | 58.95 | 41.05 | 36.70 |

| 1998 | 86531.6 | 51588.2 | 31314.2 | 59.62 | 40.38 | 36.19 |

| 1999 | 91125 | 55636.9 | 32951.5 | 61.06 | 38.94 | 36.16 |

| 2000 | 98749 | 61516 | 34842.8 | 62.30 | 37.70 | 35.28 |

| 2001 | 109027.99 | 66933.89 | 39769.4 | 61.39 | 38.61 | 36.48 |

| 2002 | 120475.62 | 71816.52 | 45565 | 59.61 | 40.39 | 37.82 |

| 2003 | 136613.43 | 77685.51 | 55963 | 56.87 | 43.13 | 40.96 |

| 2004 | 160956.59 | 87552.58 | 69168.41 | 54.40 | 45.60 | 42.97 |

| 2005 | 187423.42 | 99357.54 | 77856.82 | 53.01 | 46.99 | 41.54 |

| 2006 | 222712.53 | 113103.85 | 92954.08 | 50.78 | 49.22 | 41.74 |

| 2007 | 266599.17 | 132232.87 | 110943.25 | 49.60 | 50.40 | 41.61 |

| 2008 | 315974.57 | 153422.49 | 138325.3 | 48.56 | 51.44 | 43.78 |

| 2009 | 348775.07 | 169274.8 | 164463.22 | 48.53 | 51.47 | 47.15 |

| 2010 | 402816.47 | 194114.96 | 193603.91 | 48.19 | 51.81 | 48.06 |

| 2011 | 472619.17 | 232111.55 | 228344.28 | 49.11 | 50.89 | 48.31 |

| 2012 | 529238.43 | 261832.82 | 252773.24 | 49.47 | 50.53 | 47.76 |

| Year Range | The correlation coefficient between investment rate and saving rate | |||||

| 1991~2012 | 0.89 | |||||

| 1991~1997 | 0.72 | |||||

| 1997~2004 | 0.97 | |||||

| 2005~2008 | 0.70 | |||||

| 2009~2012 | -0.17 | |||||

Source: According to the relevant data of the National Bureau of Statistics (http://www.stats.gov.cn/).

Table 3: Savings rate and investment rate of China. Unit: 100 million RMB%.

The results in Table 3 show that China's investment rate is highly correlated with the saving rate from 1991 to 2012, and the correlation coefficient is 0.89. The correlation coefficient of the period 1991 to 1997 is 0.72, which is lower than that of the whole period 1991 to 2012. While the correlation coefficient of the period 1997 to 2004 is 0.97, which is close to 1. This suggests that China's capital controls were loosened before the Asian financial crisis, then were strengthened during the crisis. In 2004, with the Asian financial crisis subsided, China put forward the "going out" development strategy. Domestic enterprises speeded up the pace of "going out" to overseas, and China's capital controls again relaxed. The correlation coefficient of the saving rate and investment rate of the period 2005 to 2008 is 0.7, which is obviously smaller than that during the Asian financial crisis, and is the smallest among the whole period 1991 to 2012. In 2008, with the global financial crisis breaking out, the world's major developed economies fallen into deep debt and financial crisis, the world economy recovered slowly. Under this condition, large-scale international capital flows frequently between developed countries and emerging economies through hidden tools. In this period, China's economic performed well relatively, and international capital left then flowed into China rapidly.

The correlation coefficient between the investment rate and the saving rate in China is -0.17, which is not only the effect of China's stimulating consumption to expand domestic demand, but also the deepening of China's financial reform and promoting the internationalization of the RMB. So the trend of China's capital controls is to relax in long-run. Figure. 3 shows the curve of China’s investment rate and savings rate. Before the two financial crises, the curve between investment rate and savings rate shaped as horn. And the trend of the two curve is to shrink and convergence after the crisis. All these indicates that the outbreak of the crisis followed the strengthening of capital controls. By the crisis subsided, capital controls were relaxed, means that the capital market opened more widely and deeply.

Indirect verification based on real capital flow

Real capital flows are reflected in both objective international capital flows and financial openness. Therefore, these two aspects can be used to verify the intensity of China's capital controls and the trend of intensity change.

Capital Flows: Table 4 calculates the total amount of capital flows, short-term capital inflows and short-term capital outflows as a percentage of GDP to measure China's international capital mobility, the results show as below:

| Years | Total capital flows /GDP | Net capital inflows /GDP |

Short- term capital inflow /GDP |

Short- term capital outflow /GDP |

FDI/GDP | OFDI/GDP | Foreign securities investment /GDP |

Outward Foreign securities investment /GDP |

|---|---|---|---|---|---|---|---|---|

| 1982 | 0.15 | 0.08 | 0.09 | 0.85 | 0.15 | 0.02 | 0.01 | 0.01 |

| 1983 | 2.47 | -0.45 | 0.06 | 0.84 | 0.30 | 0.03 | 0.05 | 0.26 |

| 1984 | 4.11 | -1.21 | 0.35 | 2.13 | 0.46 | 0.04 | 0.30 | 0.83 |

| 1985 | 11.03 | 2.76 | 4.44 | 3.22 | 0.64 | 0.20 | 0.99 | 0.01 |

| 1986 | 12.14 | 2.20 | 3.22 | 3.92 | 0.75 | 0.15 | 0.54 | 0.01 |

| 1987 | 10.99 | 0.84 | 2.91 | 3.90 | 0.71 | 0.20 | 0.37 | 0.04 |

| 1988 | 8.72 | 1.30 | 2.26 | 2.79 | 0.79 | 0.21 | 0.30 | 0.08 |

| 1989 | 7.96 | 1.42 | 2.01 | 1.81 | 0.75 | 0.17 | 0.03 | 0.07 |

| 1990 | 11.15 | -0.71 | 2.25 | 4.67 | 0.89 | 0.21 | 0.00 | 0.06 |

| 1991 | 8.81 | 1.12 | 1.82 | 2.66 | 1.07 | 0.22 | 0.14 | 0.08 |

| 1992 | 12.43 | -0.05 | 0.53 | 0.81 | 2.29 | 0.82 | 0.18 | 0.19 |

| 1993 | 12.75 | 3.83 | 0.08 | 0.82 | 4.49 | 0.72 | 0.82 | 0.32 |

| 1994 | 16.26 | 5.84 | 0.18 | 0.80 | 6.04 | 0.36 | 0.80 | 0.17 |

| 1995 | 13.29 | 5.31 | 0.24 | 0.17 | 5.18 | 0.53 | 0.25 | 0.14 |

| 1996 | 11.91 | 4.67 | 0.15 | 0.41 | 4.95 | 0.50 | 0.39 | 0.19 |

| 1997 | 17.24 | 2.21 | 2.87 | 5.83 | 4.77 | 0.40 | 0.97 | 0.24 |

| 1998 | 18.14 | -0.62 | 4.20 | 7.92 | 4.48 | 0.44 | 0.19 | 0.55 |

| 1999 | 16.46 | 0.48 | 3.80 | 4.83 | 3.79 | 0.37 | 0.17 | 1.20 |

| 2000 | 15.19 | 0.16 | 4.74 | 6.07 | 3.51 | 0.38 | 0.65 | 0.99 |

| 2001 | 12.40 | 2.63 | 6.75 | 5.95 | 3.55 | 0.73 | 0.69 | 2.15 |

| 2002 | 15.43 | 2.22 | 4.99 | 5.41 | 3.65 | 0.43 | 0.16 | 0.87 |

| 2003 | 26.29 | 3.35 | 9.27 | 6.29 | 3.53 | 0.52 | 1.05 | 0.36 |

| 2004 | 35.65 | 5.60 | 14.04 | 12.69 | 3.53 | 0.41 | 1.80 | 0.78 |

| 2005 | 38.57 | 4.04 | 15.22 | 14.18 | 4.93 | 0.92 | 1.15 | 1.36 |

| 2006 | 52.18 | 1.67 | 21.21 | 19.47 | 4.91 | 1.22 | 1.83 | 4.35 |

| 2007 | 54.08 | 2.61 | 21.31 | 23.11 | 4.85 | 0.87 | 2.21 | 1.74 |

| 2008 | 42.60 | 0.82 | 15.20 | 17.76 | 4.13 | 1.59 | 1.93 | 1.16 |

| 2009 | 30.54 | 3.90 | 12.21 | 9.96 | 3.35 | 1.60 | 2.21 | 1.66 |

| 2010 | 34.42 | 4.76 | 14.22 | 12.31 | 4.60 | 1.47 | 1.07 | 0.67 |

| 2011 | 35.89 | 3.55 | 14.13 | 13.41 | 4.53 | 1.36 | 0.71 | 0.44 |

| 2012 | 33.65 | -0.26 | 52.30 | 47.76 | 3.74 | 1.42 | 1.01 | 0.43 |

Source: According to the State Administration of Foreign Exchange Web site (http://www.safe.gov.cn) [3].

Table 4: China's Capital Mobility and Financial Openness. Unit: %.

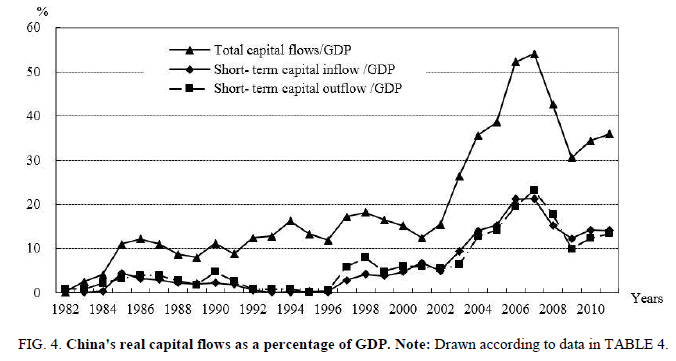

1. The index for the total amount of capital flows as a percentage of GDP. Before 2001 the index fluctuated up slightly from 10% to 20%. From 2001 to 2007, the index grown rapidly, from 12.4% in 2001 to 54.08% in 2007, with an increase of 3.4 times in 6 years. Since the breakout of world finance crisis, the index dropped significantly. In 2008 and 2009, the index decreased by 12% respectively. Then has a slight increase in fluctuations and maintained at around 35%, which has a significant difference with the value more than 50% before the crisis. In general, China's total international capital flows as a percentage of GDP is tend to rising, this indicates that the intensity of China's capital controls tend to weaken. In a certain period the value of the index declined, even at a certain time declined significantly. These indicate that China's capital controls have been strengthened in particular period. So China's response to international capital flow shocks was relatively flexible.

2. The index for short-term capital flows as a percentage of GDP. Both short-term capital inflows and outflows as a percentage of GDP are similar to the total amount of capital flows as a percentage of GDP (Figure. 4). So, we can calculate the correlation coefficients between these indexes from 1982 to 2011 respectively to verify the intensity of capital control. The correlation coefficient between the index of short-term capital inflows and total capital flows is 0.96, and that between outflows and total is 0.95, while that between outflows and inflows is 0.97. All the correlation coefficients are close to 1, means short-term capital inflows, outflows and total capital flows are highly correlated between each other. This shows that the international capital flows into and leave China are mainly short-term, meanwhile the short-term capital inflows and outflows are relatively balanced.

Figure 4: China's real capital flows as a percentage of GDP.

Note: Drawn according to data in TABLE 4.

Financial openness: The indexes of financial openness reflects the intensity of capital controls indirectly. It includes direct investment as a percentage of GDP and portfolio investment as a percentage of GDP.

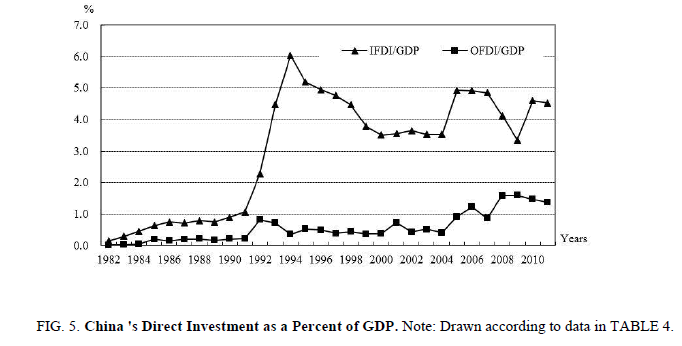

1. The index for direct investment as a percentage of GDP. The direct investment is divided into inward foreign direct investment and outward foreign direct investment (Table 4 and Figure. 5).

Firstly, the overall trend of the index for the proportion of inward foreign direct investment in GDP is incremental through the data in TABLE 4. But there are several discontinuous nodes obviously, such as 1991, 1994, 1997, 2004 and 2007. Before 1991, the index maintenance less than 1%. After 1991, the index increased rapidly and reached a historical maximum of 6.04% in 1994. In 1997 with the outbreak of the Asian financial crisis, the index dropped to 3.51% in 2000 and maintained for 5 years without major fluctuations. Until 2005, it rose to more than 4%. In 2008 with the global financial crisis, the index showed a downward trend once again and fell to 3.31% in 2009 as the lowest in nearly 20 years. It gradually rebounded two years later.

Secondly, the overall trend of the index for the proportion of outward foreign direct investment in GDP is also increasing. But the growth extent is much smaller than that of inward. Meanwhile the stage characteristics of the index of outward are obviously too. Before 1992, the index remained below 0.2%. China's outward foreign direct investment was negligible in this period. From 1992 to 2004, the index fluctuated around 0.5%, that indicates China's outward foreign investment remained cautious. Since 2004, the index increased gradually and reached a maximum of 1.6% in 2009, then maintained at around 1.4%. And the impact of the two major financial crises on outward foreign direct investment is much less than that on inward foreign direct investment. This reflects that China has eliminated restrictions on inward foreign direct investment, while the control of outward foreign direct investment is still much strict. Though in 2004, the capital outflow controls have been relaxed in somewhat, but the pace of “go out” remains sluggish.

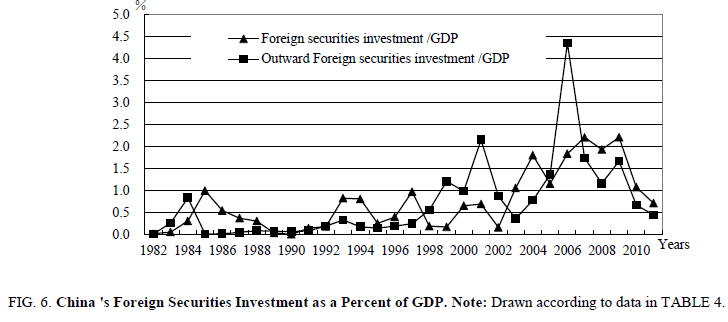

2. The index for portfolio investment as a percentage of GDP, similar to direct investment, is also divided into capital inflows and outflows. Figure. 6 reflects the trend of this index. From the long-term trend, the indexes of inflows and outflows are both increasing. But there is large difference between the growth extents of them. The growth rate of outward portfolio investment is larger than of that of inward portfolio investment. Outward portfolio investment to GDP ratio in 2006 reached a maximum of 4.35%, while the maximum inward portfolio investment in GDP ratio is 2.21% in 2007. The latter is only half of the former. At the same time, the fluctuation of inward index is more stable than that of outward. All these reflects China is more cautious on inward portfolio investment than on outward.

Figure 6: China 's Foreign Securities Investment as a Percent of GDP.

Note: Drawn according to data in TABLE 4.

Conclusion

In summary, the direct measurement on the intensity of China's capital control shows that: The intensity of China's capital controls tends to be weakened in general, and the relaxation of capital inflow control precedes capital outflow control. On the view of time nodes, China has relaxed the control of capital outflows after two financial crises. Meanwhile, the controls on capital inflow and outflow have been relaxed partially in 2004.

Indirect verification results show that China's capital controls tend to be weakened in the long run. The international capital flows into China decreased significantly after the two financial crises. Although it cannot be completely due to the strengthening of capital controls, at least there are certain relation with the measures of capital control during the crisis. And the intensity of capital controls measured by various indicators in 2004 has been declined. From the perspective of total capital flows, China has tightened capital control during the two financial crises. With the financial crisis recedes and the economy recovers, China has gradually relaxed its control over international capital flows. This shows that the direct measurement on intensity of China's capital control and its trend of intensity change have been well verified indirectly. The intensity changes of China's capital control would be reflected on the volatility in international capital flows inevitably. Especially the short-term international capital flows have a higher correlation with the adjustment of the intensity of capital control.

Funding

The paper is based on work funded by Zhejiang Provincial Philosophy and Social Sciences Planning of China under Project No. 16NDJC060YB. The project provides great help to the study design and paper writing.

References

- IMF,1998?2012 “Annual Report on Exchange Arrangements and Exchange Restrictions”, IMF.

- Yongding Y, Ming Z.New international trends of capital control and capital account liberalization. Int Econ Rev. 2012;5:68-74.

- State Administration of Foreign Exchange, “Foreign Exchange Management Overview” edition, Chapter III, 2009.

- El-Shagi M. Capital controls and international interest rate differentials. Appl Econ. 2010;42(6):681-8.

- Schindler M. Measuring financial integration: A new data set. IMF Staff Papers. 2009;56(1):222-38.

- Elibrary/Series/Periodicals and Reports/Annual Report on Exchange Arrangements and Exchange Restrictions.

- Martin F, Horioka C. Domestic Savings and International Capital Flows. Nber Working. 1980;358:314-29.

- Obstfeld M. Capital controls, the dual exchange rate, and devaluation. J Int Econom. 1986;20(1-2):1-20.